| Many home educators choose to use curriculum or resources not readily available in NZ, or less expensive from elsewhere, and so order from overseas. BUT there can be added costs at the border if you're not aware of a few important points: (ACE users - make sure you read the extra info and example at the end of this article!) |

2) Some products attract duty - for example, toys have a 5% duty on them - while others do not. Books have no duty. Nearly all imported products are liable for GST at 15%

4) GST and Duty are calculated on the TOTAL VALUE OF THE PRODUCTS INCLUDING SHIPPING, converted to NZ dollars at the Customs rate of exchange. Custom's exchange rates are always slightly less favourable than the bank's rates, making the value of the item slightly more than what you may have actually paid for it.

5) When GST and duty are calculated to be LESS than $60, Customs will waive it and you will not be charged. Their reasoning is that the cost of collection makes it not worth pursuing smaller amounts.

6) When GST and duty are calculated to be $60 or more, you will be charged for those PLUS a Custom's entry fee of $49.24. You will have to pay the total amount before your parcel is released.

7) You can use the What's My Duty calculator on the Custom's website HERE to work out what your likely duty, GST and charges will be on items you are considering importing.

A useful rule-of-thumb is that if the total value of a parcel of books or curricula is worth LESS than NZ$400, including shipping, then you won't be charged GST etc.

* If a parcel contains items which have duty on them - eg educational toys - then this could put the total amount over the threshold, and you will be charged that duty, plus GST on everything, plus the entry fee.

* Do NOT cut the margin too fine! If you place an order for JUST under NZ$400, and rates change, you could end up with additional costs of over $100! I suggest a "margin for error" of at least $20.

* And don't forget shipping/freight charges are included in the "value" of the parcel!

* NEVER ask a person sending you product from overseas to falsify the value on the parcel - you can held libel for fraud and it can cost you even more!

* If you want items with a value over the threshold, split your orders, BUT try to separate the orders by a couple of weeks or more, as Customs does have the right to combine parcels coming in and charge duty/GST on the combined value. Keep in mind that they can combine totals on multiple parcels from separate sources that arrive at the same time, not just multiple parcels from the same source.

1) Family X order various books and curriculum from an American website. The total value of the order, including shipping, in U.S dollars was $253.00

When it arrives in NZ, the Customs U.K exhange rate is 0.54, so the NZ value of the parcel is $300/0.54 = $555.56. Again, there is no duty, but the GST on the parcel comes to $83.33. The family will be charged that plus the entry fee, so a bill totalling $132.57 is sent to them.

The rate of exhange is 0.67. In this case, Customs will covert the books/shipping value to $298.51. The toys NZ value is $89.55. Together these total less than $400, HOWEVER, the costs add up like this:

Duty on toys @5% = $4.48

GST @15% = $58.21

Entry fee: $49.24

Total to pay: $111.93

This is because the duty and GST combined cross the $60 threshold.

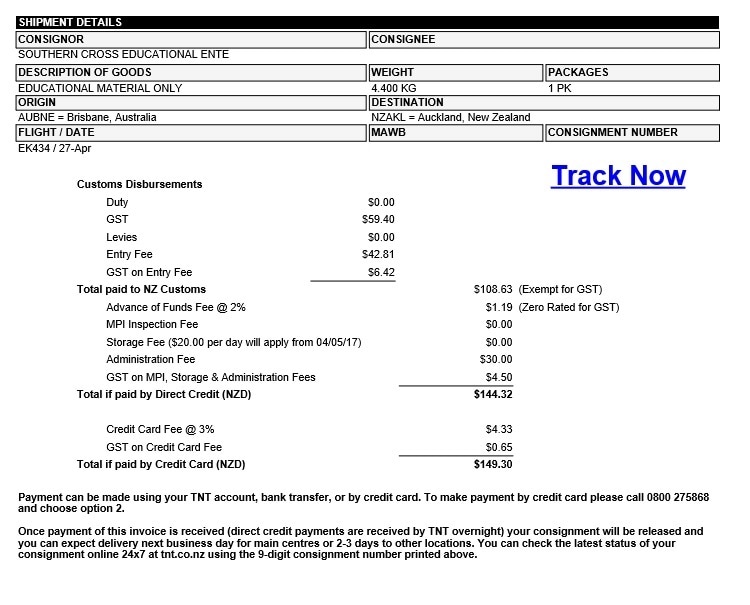

This family ordered curriculum totalling AUD355.02 including shipping. They had worked out that this was less than NZ400 and so should not attract duty and fees. So they were rather upset when they recieved this bill:

2) This bill was issued by TNT, not Customs. When companies ship goods from overseas via carriers other than the standard mail, or using airway bills, then their handlers at this end do their own calculations of things and collect money on behalf of customs. In this case, you can see that they then also add their own additional fees!

3) TNT was operating on the erroneous assumption that since GST plus the entry fee came to over $60, they should charge. Customs entry fee is NOT included in the $60 threshold (if it were, you could expect to be charged on all parcels over about NZ$70 in value!)

4) If this hadn't been paid or sorted out within 3 business days, TNT were going to add extra charges of $20/day for "storage"!

So, if you're ordering from SCEE, be extra careful your parcel will come in well under the NZ$400 threshold, including shipping or you'll get extra charges upon extra charges! Watch this, or consider an alternative source of Paces.

RSS Feed

RSS Feed