Southern Cross Educational Enterprises (SCEE)

Member Discounts and Ordering: One can order from SCEE either as a member of one of the affiliated schools or support agencies, or independently. The two affiliates for NZ home educators are HENZ (Home Education NZ) or Accelerate. Accelerate is the distance arm of SCEE, and is based in Australia. Just in the last couple of years SCEE has started directing NZ families to them rather than HENZ. High school age students under either of these work towards the ACE Certificate program, which is controlled by SCEE. A part of the contract requires that students paces be purchased from SCEE; if they don't see what they consider a suitable ordering history to indicated this, they will refuse to issue the certificate.

Families who are members of SCEE or Accelerate have a 5% discount on the cost of materials. According to the most recent invoices I've seen, they are also not charged GST on their orders (if anyone has a more recent order which shows differently, please let me know), though this may change as it does not appear to be in line with the current laws* (see below for more on this). Affiliate families order online through the webstore; their order will have their discount applied, shipping added and be in Australian dollars, which is how it is charged to their credit cards and then converted by their banks at whatever the current exchange rate is.

Both HSNZ families and others who choose to use ACE resources without belonging to a support agency can order from SCEE if they choose to do so. However, the billing system is more complex. Below is a brief outline. This difference is something SCEE instituted when the new GST laws came into effect, requiring overseas companies who sell more than $60K of goods or services to NZ customers per year to register for GST, collect it from customers on orders under $1000, and pay it to IRD. Here's how it works:

- A customer orders materials through the SCEE webstore (or via email etc). On the webstore, they are billed in Australian dollars, with shipping added. They get a confirmation of order email in Aussie dollars just like they saw on the webstore.

- Next they get a new invoice. This time it's in NZ dollars, with the SCEE NZ* company listed, and shipping AND GST are added. They then need to pay the amount on this invoice by internet banking or Paypal.

- A significant fact is that the cost of the materials is not the AUD price converted at the current exchange rate, but a pre-set NZ price that is higher than the AUD equivalent. A recent invoice I saw put this at NZ$7.19 per pace/score key, plus GST and shipping. This can mean that what you get billed is significantly more than you may have expected when placing the order on the website, not just because of GST but also because of the higher pricing, which adds up over a number of items. Notably, nowhere on the website or webstore does it advise of these pricing or ordering process differences. GST is charged on both product and shipping (which is also a service) as required by the legislation.

Alternative Suppliers

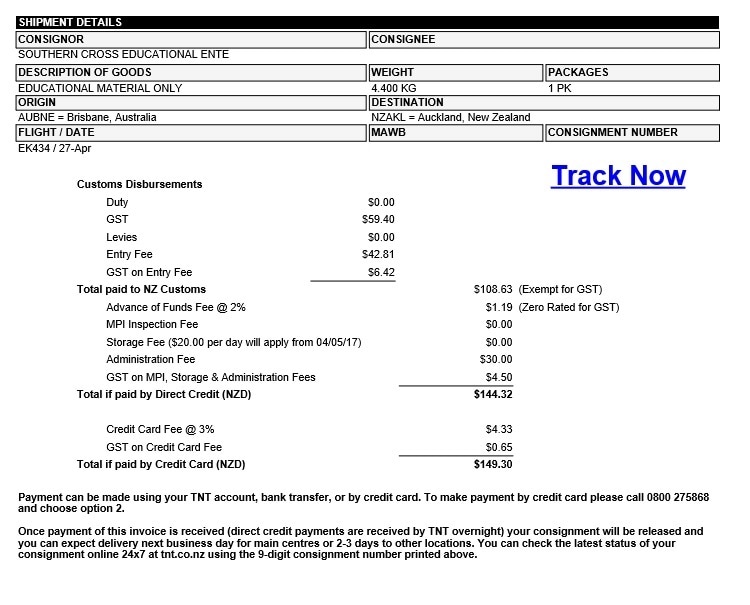

For Homeschooling NZ families only there is an arrangement in place with a specific U.S supplier. Details of this can be found on the HSNZ member Noticeboard or in the ordering information document under Resources on their website. As this is a company that supplies less than the $60K of product to NZ each year, they do not charge GST. Ordering is done by email to a specified contact rather than through their website, and they are great about minimizing shipping costs where possible. They email an invoice which can be paid by credit/debit card or Paypal. Their current per-pace price for most items is $3.20 US, which works out today to NZ$4.14, plus shipping. If your order is over $1000 including shipping you will be charged GST and duty at the border by NZ Customs, so keep that in mind if placing larger orders.

Other families choose to order from other U.S suppliers using a YouShop drop shipping address. This can be set up via NZ Post. When ordering via YouShop, the supplier is sending to, effectively, a U.S address, and may offer free shipping. NZ Post then calculates shipping to NZ, and charges that and a service fee, plus GST, to send the parcel on to you. NZ Post will also charge GST on the value of the product ordered, not just their shipping and services, regardless of the value of the parcel. The legislation requires them to do so.

Summary

- For HENZ or Accelerate families, ordering from SCEE is usually cheapest due to a 5% discount and not (currently) being charged GST.

- For non-affiliate families, other U.S suppliers may be the most cost effective option. Note, however, that NZ Math and Social Studies paces can only be ordered from SCEE (though for HSNZ families there are alternatives to these)

RSS Feed

RSS Feed